16.08.2022

The Voice of Ukrainian Startups (Research Results): More than half of startups continue their operations exclusively from Ukraine

The Ukrainian Startup Fund in partnership with TechUkraine, the Ministry of Digital Transformation of Ukraine, Emerging Europe, Tech Emerging Europe Advocates, Global Tech Advocates, and TA Ventures, have published the results of a survey looking at the country’s start-up ecosystem - "The country at war: The voice of Ukrainian Startups”.

The goal of the research was to understand the impact of the Russian invasion on Ukrainian startups after months of heroic resistance, analyse the dynamics of the sector and find the most effective ways of support.

The project is aimed at promoting Ukrainian startups through international media, venture funds and other global stakeholders.

***During the field period, between June 2 and August 3, 2022, 153 responses from Ukrainian start-ups were received, The survey was delivered through multiple channels, including social media, partners, and private and corporate email communication.

_____________________________________________

Additional Information

Ukrainian Startup Fund is the first state fund, launched in 2018 under the umbrella of the Ministry of Finance, with a mission to provide financial and further assistance in order to promote Ukrainian start-ups and increase their global competitiveness.

TechUkraine is a platform based on the desire to strengthen the Ukrainian technological ecosystem and place Ukraine among the leading technological countries in the world. TechUkraine focuses on supporting Ukraine’s fast-growing tech ecosystem, driving the cooperation of ecosystem leaders, government officials, business partners, and donors to further support Tech and to spread the word.

Ministry of Digital Transformation is a government ministry in Ukraine established in August 2019. Key goals of the ministry include increasing the growth of the Ukrainian IT sector, increasing its share of the economy, and increasing the export of high-tech products and services from Ukraine.

Emerging Europe is a mission-driven enterprise and a growth hub focused on 23 countries of Central, Eastern, South-Eastern Europe and the South Caucasus. Headquartered in London, with analysts and correspondents on the ground in key locations across the region, Emerging Europe is well-placed to react to major events and set the agenda for constructive debate.

Tech Emerging Europe Advocates is a community of tech entrepreneurs, leaders, experts and investors eager to make emerging Europe a global tech hub, a part of the 30,000+ member Global Tech Advocates network. The community is led by Emerging Europe.

TA Venture is an early-stage venture capital fund founded by Ukrainians backing ambitious founders of technology companies across different verticals in Europe and North America. The VC is based in Kyiv, Frankfurt, London, Boston, and Los Angeles. Since 2010 TA Ventures has invested in 200+ companies, primarily in the US and Europe, alongside top investors and angels.

***During the field period, between June 2 and August 3, 2022, 153 responses from Ukrainian start-ups were received, The survey was delivered through multiple channels, including social media, partners, and private and corporate email communication.

_____________________________________________

Additional Information

Ukrainian Startup Fund is the first state fund, launched in 2018 under the umbrella of the Ministry of Finance, with a mission to provide financial and further assistance in order to promote Ukrainian start-ups and increase their global competitiveness.

TechUkraine is a platform based on the desire to strengthen the Ukrainian technological ecosystem and place Ukraine among the leading technological countries in the world. TechUkraine focuses on supporting Ukraine’s fast-growing tech ecosystem, driving the cooperation of ecosystem leaders, government officials, business partners, and donors to further support Tech and to spread the word.

Ministry of Digital Transformation is a government ministry in Ukraine established in August 2019. Key goals of the ministry include increasing the growth of the Ukrainian IT sector, increasing its share of the economy, and increasing the export of high-tech products and services from Ukraine.

Emerging Europe is a mission-driven enterprise and a growth hub focused on 23 countries of Central, Eastern, South-Eastern Europe and the South Caucasus. Headquartered in London, with analysts and correspondents on the ground in key locations across the region, Emerging Europe is well-placed to react to major events and set the agenda for constructive debate.

Tech Emerging Europe Advocates is a community of tech entrepreneurs, leaders, experts and investors eager to make emerging Europe a global tech hub, a part of the 30,000+ member Global Tech Advocates network. The community is led by Emerging Europe.

TA Venture is an early-stage venture capital fund founded by Ukrainians backing ambitious founders of technology companies across different verticals in Europe and North America. The VC is based in Kyiv, Frankfurt, London, Boston, and Los Angeles. Since 2010 TA Ventures has invested in 200+ companies, primarily in the US and Europe, alongside top investors and angels.

"To support the national start-up ecosystem, we must respond in time to the challenges of the war facing the innovation industry. It is essential to hear the voice of every start-up during this challenging period for the country. That's why in the first days of the war, we launched a series of online surveys addressed to Ukrainian startups. This is the second study and it once again confirms the extraordinary resilience of the ecosystem. After all, most start-ups adapted as much as possible to the new reality in order to survive, continue to work and support the economy. They proved in practice that a business could grow, scale, and attract investment despite difficult times. Ukrainian start-ups are solid and competitive even during the war. Now they are a supporting industry, which can become the basis for the post-war reconstruction of Ukraine", Pavlo Kartashov, CEO of Ukrainian Startup Fund.The survey "The country at war: The voice of Ukrainian startups" covered essential topics such as registration and relocation of startups and teams, financial situation, sector and market development, support received since the invasion began, short and long-term plans.

"Even during Russia's full-scale invasion, the Ukrainian IT market has continued to operate. The results of this research will allow us to better understand the way the IT industry and the start-up ecosystem has developed during the war, as well as to identify priority spheres for building better cooperation between government, business, international funds and investors", Oleksandr Bornyakov, Deputy Minister of Digital Transformation of Ukraine for IT Industry Development. According to Andrew Wrobel, founding partner at Emerging Europe and leader of the organisation’s Tech Emerging Europe Advocates community, “This report is here to give an overview of the start-up and tech ecosystem and showcase some of the excellent solutions and founders who are behind them.” "We must preserve the potential of Ukrainian start-ups and help Ukrainian tech innovators to develop even in these difficult times. The project The country at war: The voice of Ukrainian Start-ups will provide an opportunity to identify the main needs and the most effective ways to support the Ukrainian start-up ecosystem. In addition, the TA Ventures team has already developed a map of start-ups with priority verticals that will help rebuild Ukraine and the Ukrainian economy. We are already finalising this map together with the Ministry of Digital Transformation of Ukraine and the Ukrainian Start-Up Fund", Victoria Tigipko, Chair of the Supervisory Board of the Ukrainian Start-Up Fund, and Managing Partner, TA Ventures. "Despite the adverse conditions created by the war, like Ukraine as a whole, the country’s tech sector is showing remarkable resilience. Unsurprisingly, the economy is expected to shrink this year — yet exports of Ukraine’s IT services continue to grow. As the tech sector refuses to buckle under the pressure of war, Ukraine’s 200,000 tech pioneers, entrepreneurs and innovators continue to demonstrate the resilience and determination of their sector. The indefatigable spirit and raw talent of its people stand Ukraine in good stead on its trajectory towards becoming a truly global tech hub. And we are really proud that in March, the launch of the Ukraine Chapter of Tech Emerging Europe Advocates went ahead as planned", Russ Shaw, CBE Founder, Tech London Advocates and Global Tech Advocates.Key findings:

- - Despite the ongoing war, Ukrainian start-ups — similarly to the country’s IT sector — have demonstrated resilience and entrepreneurs continue to operate their businesses and remain committed to their success even in these dire circumstances.

- - Some Ukrainian start-ups have relocated but the vast majority have kept at least a part of their operations or team in Ukraine. Also, those start-ups that have not relocated are not planning on doing so at the moment. And more than half continue their operations exclusively from Ukraine.

- - More than one in ten start-up employees has had to leave their respective firms since the beginning of Russia’s invasion. Not all start-ups, however, have experienced team reduction. More than four in ten start-ups have not seen any change

- - Nine out of ten start-ups confirm they need financial support to continue operations and/or expand. But there is a small percentage that say they do not require any assistance.

- - Whether they need financial support or not, more than half of all start-ups surveyed say they expect to expand their operations in the short-term. Every fourth start-up says they will maintain the status quo. Only four per cent of start-ups believe their operations might be reduced

- - 95% of start-ups stated that they remain in Ukraine at least partially, while 55.7% continue their operations exclusively from Ukraine

- - The most popular foreign destinations include the countries of the European Union (38.6%) and the United States (10%)

- - While 44% of start-ups have already relocated, 56% remain settled in their previous location

- - Moreover, 78% of those start-ups which have not relocated are not considering relocation at the present time, while just 12% are thinking about it.

- - Another 10% have yet to decide whether or not they will relocate.

Alyona Mysko, founder and CEO of Fuelfinance, a cloud-based accounting platform, says that, “We have to run our business and serve our clients. We are doing that. Plus, our country needs financial support. Ukrainian businesses need to remain viable. Employees need salaries. Most of Fuel’s employees are still in Ukraine. We’re working hard on Fuel while volunteering and helping military forces and other businesses.”Market:

- - Ukraine remains the key market for 60% of the country’s start-ups, followed by the European market (EU and EEA; 46.4%) and North America (United States 34.3%, Canada (9.3%).

- - Every fifth Ukrainian start-up considers the global market as their main target.

One start-up surveyed, Tendido, says: “Entering the African market together with the World Health Organisation (WHO) as part of the mission to save people's health and lives. Now the main goal is to start sales in Ukraine and the EU. In the long-term — the source market is the USA and Asia.”Team:

- - Ukrainian start-ups have lost about 12.7% of team members since the war began.

- - At the same time, 43.2% declared that they have not experienced any change in the count of employees.

- - More than half of start-ups who remain in their initial locations reported that the war has not impacted their team count.

- - 37.4% of start-up teams became smaller, while every fifth start-up declared expansion of the team. For relocated teams this figure is even higher – a quarter of teams grew in size.

- - Overall, teams that had up to 10 employees before the war have shown greater resilience than those employing 11+ people.

Viktoria Nalyvaiko and Oksana Gorbunova, Co-founders of BazaIT: “We want to build and bring Ukrainian local product companies to the international arena, develop the IT of our country.”Financial state:

- - The financial state of Ukrainian start-ups is considered to be unstable, with almost half having a run rate of one to three months.

- - 13% of relocated teams say that they will manage going forward, while among non-relocated start-ups that figure reaches just 3.2%

ComeBack Mobility: “We need functional integration of complex chains for the supply of agricultural products to European countries and export through European ports. What is also needed is launching a digital invoice — a pilot launch in other countries and markets, namely the US, Brazil, Argentina.”Support and development:

- - Nine out of 10 start-ups indicate that they require financial support

- - Only one in five say that they have already received support.

- - Just 1.4 per cent of respondents stated that they did not need any support to continue their operations.

- - A quarter of respondents indicated that they have got new contacts to help retain and grow their business during the war, while 35.7% are seeking new contacts in their field.

Andriy Myrhorodskyi CEO, BioBin: “Since Ukrainians are used to digital solutions in many industries, we decided to relaunch our efforts with a completely new product. We are developing an MVP of the automated recycling bins network run with a smartphone with a sortto-earn built-in function.”Investments:

- - According to the survey, over 48% of start-ups said that revenue or new investment would be needed over the next three months in order to allow them to continue operating at current levels.

- - An additional third of start-ups said that they would face problems within six months.

Monte Davis, CEO Demium: “Those start-ups who offer services outside of the Ukraine and count on customers throughout Europe and the world have been less impacted. These companies continue to grow and have even had an easier time attracting new foreign customers as the world seeks to support Ukrainians in a difficult time. Those start-ups that depend on the local market are having a much harder time as they find it difficult to gain the momentum that they need. Overall, Ukraine’s start-up ecosystem has shown an incredible resilience as they navigate the management of their ventures in a situation that many can simply not fathom.”Ecosystem overview:

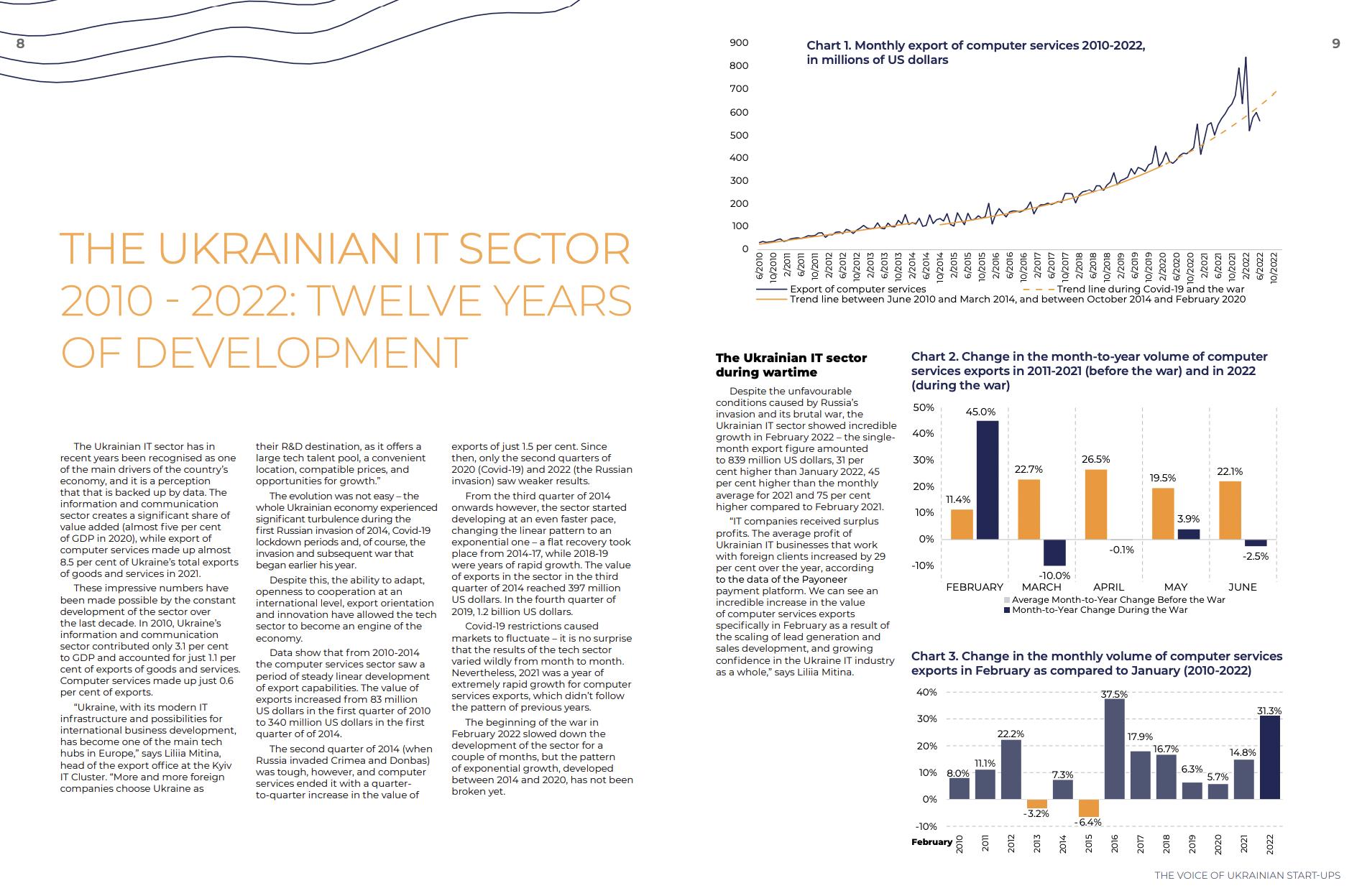

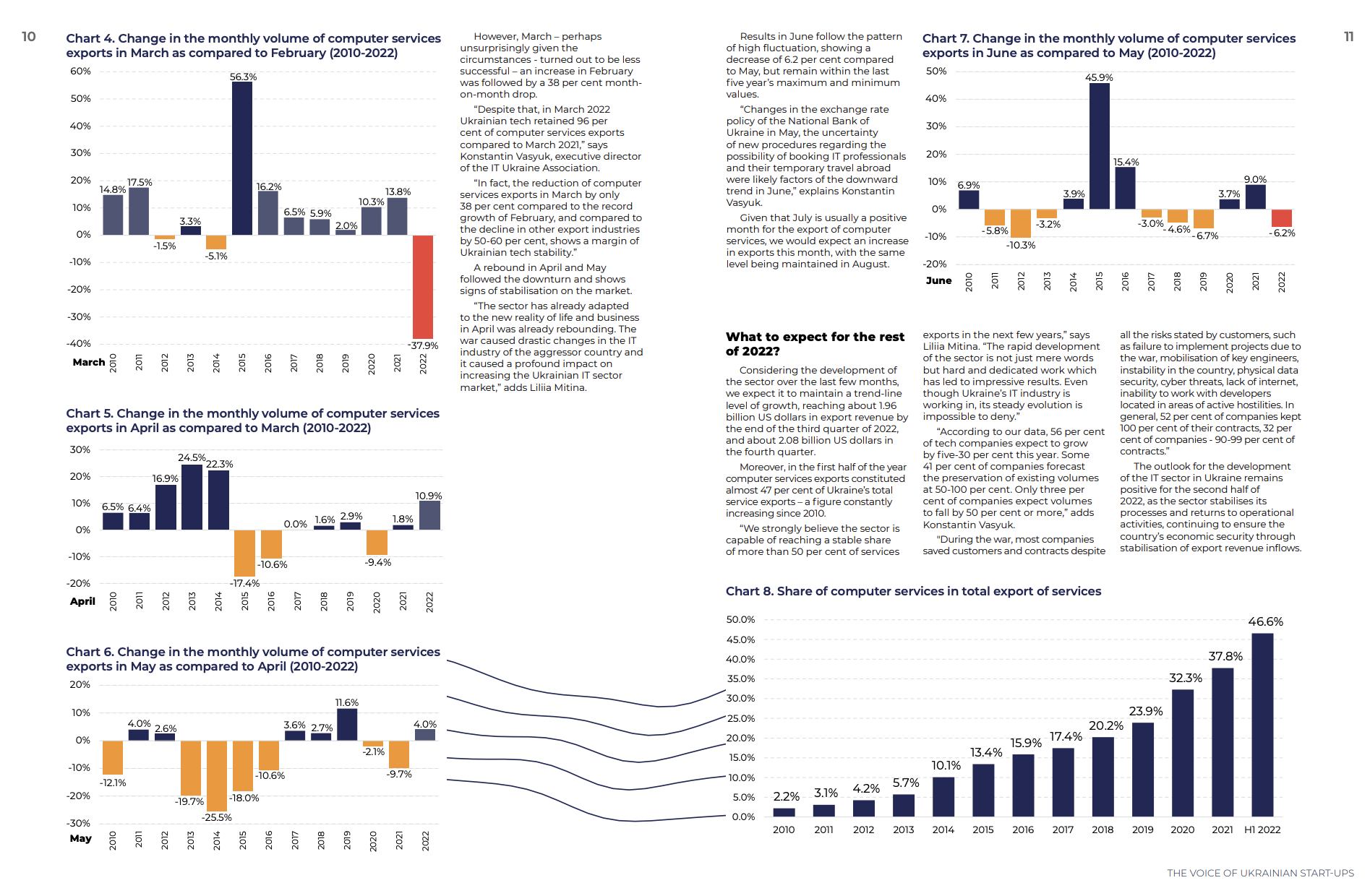

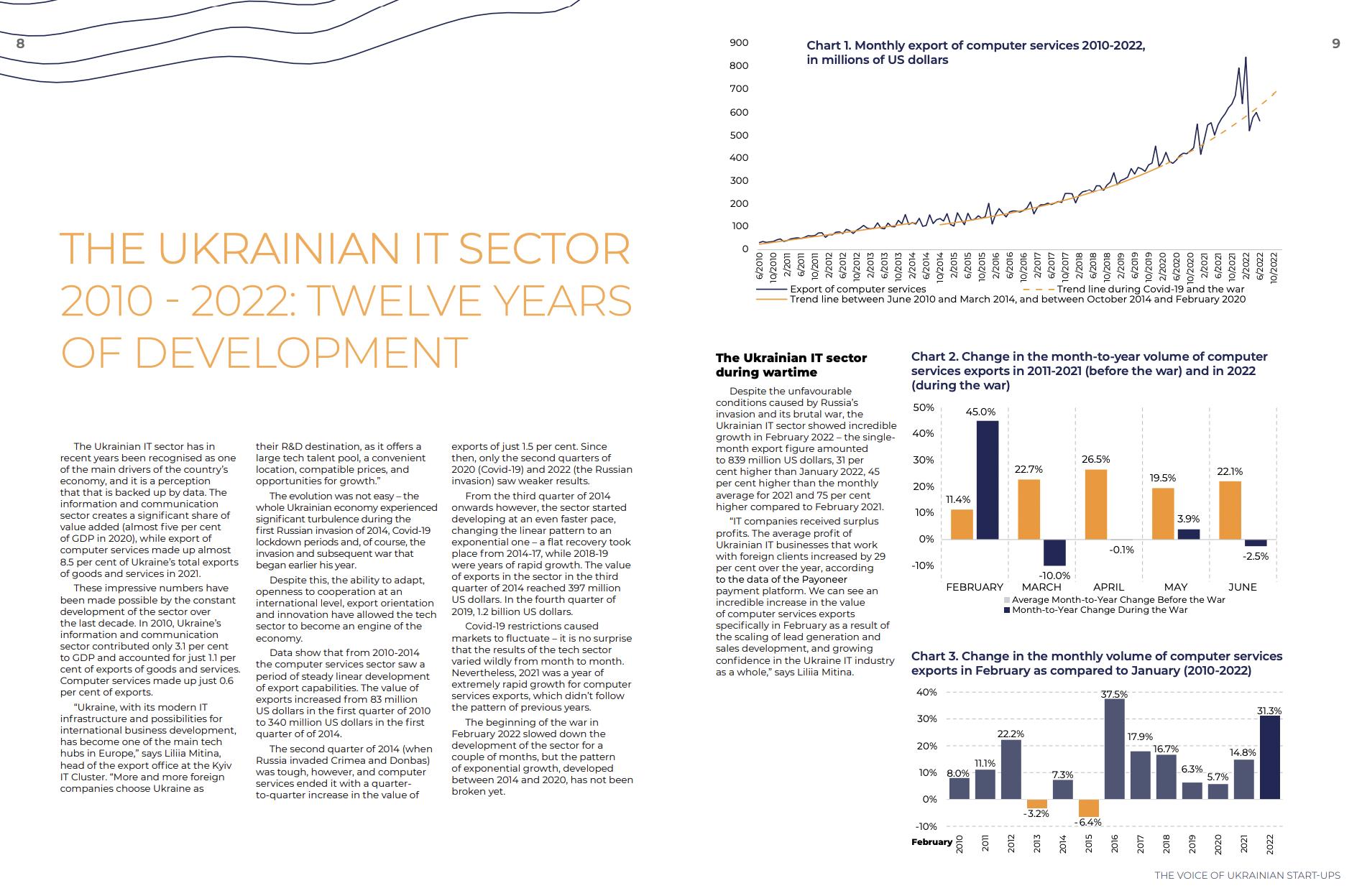

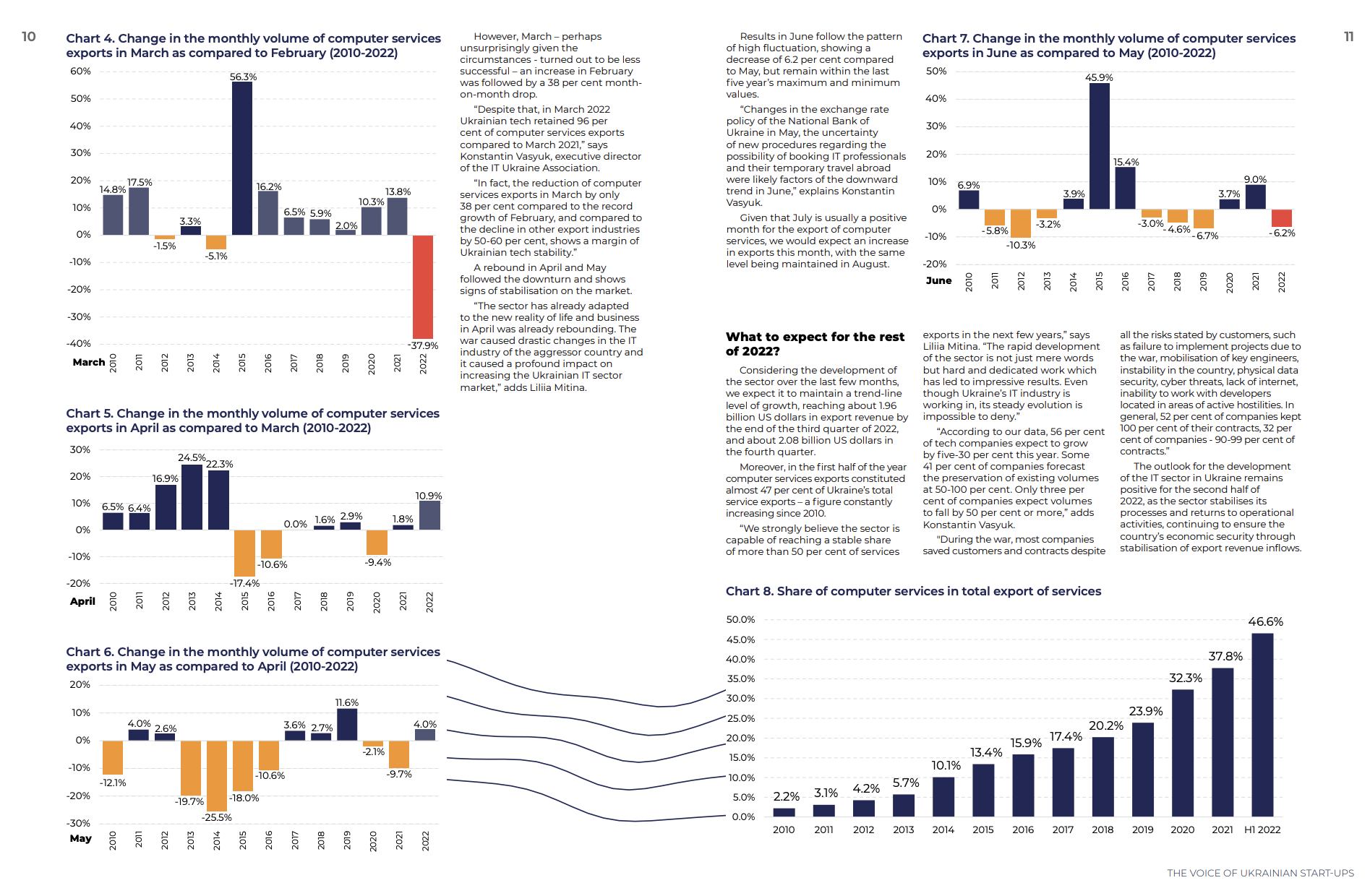

- - Despite the unfavourable conditions caused by Russia’s invasion and its brutal war, the Ukrainian IT sector showed incredible growth in February 2022 – the single month export figure amounted to 839 million US dollars, 31 per cent higher than January 2022, 45 per cent higher than the monthly average for 2021 and 75 per cent higher compared to February 2021.

- - Despite the war, two Ukrainian tech companies have joined the Ukrainian unicorns list — airSlate and Unstoppable Domains (which is US-based but has Ukrainian founders). Ukraine’s Preply meanwhile raised 50 million US dollars to scale up globally.

- - The outlook for the development of the IT sector in Ukraine remains positive for the second half of 2022, as the sector stabilises its processes and returns to operational activities, continuing to ensure the country’s economic security through stabilisation of export revenue inflows.

Nataly Veremeeva Director, TechUkraine: “The fight is not only on the battlefields, but also in the economy, that needs to keep being strong. We at TechUkraine are happy to be a valuable part of this important process.”Full text: https://emerging-europe.com/support-digital-ukraine/

***During the field period, between June 2 and August 3, 2022, 153 responses from Ukrainian start-ups were received, The survey was delivered through multiple channels, including social media, partners, and private and corporate email communication.

_____________________________________________

Additional Information

Ukrainian Startup Fund is the first state fund, launched in 2018 under the umbrella of the Ministry of Finance, with a mission to provide financial and further assistance in order to promote Ukrainian start-ups and increase their global competitiveness.

TechUkraine is a platform based on the desire to strengthen the Ukrainian technological ecosystem and place Ukraine among the leading technological countries in the world. TechUkraine focuses on supporting Ukraine’s fast-growing tech ecosystem, driving the cooperation of ecosystem leaders, government officials, business partners, and donors to further support Tech and to spread the word.

Ministry of Digital Transformation is a government ministry in Ukraine established in August 2019. Key goals of the ministry include increasing the growth of the Ukrainian IT sector, increasing its share of the economy, and increasing the export of high-tech products and services from Ukraine.

Emerging Europe is a mission-driven enterprise and a growth hub focused on 23 countries of Central, Eastern, South-Eastern Europe and the South Caucasus. Headquartered in London, with analysts and correspondents on the ground in key locations across the region, Emerging Europe is well-placed to react to major events and set the agenda for constructive debate.

Tech Emerging Europe Advocates is a community of tech entrepreneurs, leaders, experts and investors eager to make emerging Europe a global tech hub, a part of the 30,000+ member Global Tech Advocates network. The community is led by Emerging Europe.

TA Venture is an early-stage venture capital fund founded by Ukrainians backing ambitious founders of technology companies across different verticals in Europe and North America. The VC is based in Kyiv, Frankfurt, London, Boston, and Los Angeles. Since 2010 TA Ventures has invested in 200+ companies, primarily in the US and Europe, alongside top investors and angels.

***During the field period, between June 2 and August 3, 2022, 153 responses from Ukrainian start-ups were received, The survey was delivered through multiple channels, including social media, partners, and private and corporate email communication.

_____________________________________________

Additional Information

Ukrainian Startup Fund is the first state fund, launched in 2018 under the umbrella of the Ministry of Finance, with a mission to provide financial and further assistance in order to promote Ukrainian start-ups and increase their global competitiveness.

TechUkraine is a platform based on the desire to strengthen the Ukrainian technological ecosystem and place Ukraine among the leading technological countries in the world. TechUkraine focuses on supporting Ukraine’s fast-growing tech ecosystem, driving the cooperation of ecosystem leaders, government officials, business partners, and donors to further support Tech and to spread the word.

Ministry of Digital Transformation is a government ministry in Ukraine established in August 2019. Key goals of the ministry include increasing the growth of the Ukrainian IT sector, increasing its share of the economy, and increasing the export of high-tech products and services from Ukraine.

Emerging Europe is a mission-driven enterprise and a growth hub focused on 23 countries of Central, Eastern, South-Eastern Europe and the South Caucasus. Headquartered in London, with analysts and correspondents on the ground in key locations across the region, Emerging Europe is well-placed to react to major events and set the agenda for constructive debate.

Tech Emerging Europe Advocates is a community of tech entrepreneurs, leaders, experts and investors eager to make emerging Europe a global tech hub, a part of the 30,000+ member Global Tech Advocates network. The community is led by Emerging Europe.

TA Venture is an early-stage venture capital fund founded by Ukrainians backing ambitious founders of technology companies across different verticals in Europe and North America. The VC is based in Kyiv, Frankfurt, London, Boston, and Los Angeles. Since 2010 TA Ventures has invested in 200+ companies, primarily in the US and Europe, alongside top investors and angels.